Understanding fixed asset accounting is fundamental for businesses to effectively manage their long-term tangible and intangible assets. It involves evaluating asset valuation methods, depreciation, and lifecycle management, influencing financial statements and overall company performance. Properly recording fixed asset entries ensures accurate financial reporting and adherence to accounting standards. Fixed asset accounting involves recording and tracking the acquisition, depreciation, and disposal of fixed assets in a company’s financial statements. This process ensures that the value of fixed assets is accurately reflected on the balance sheet and income statement over their useful lives. Fixed https://www.bookstime.com/articles/1-800accountant assets must be removed from the balance sheet when the asset is disposed of, such as sold, exchanged, or retired from operations.

- This method is used only when calculating depreciation for equipment or machinery, the useful life of which is based on production capacity rather than a number of years.

- It involves adding together each year in an asset’s useful life and then using that sum to calculate a percentage representing the remaining useful life of the asset.

- Revaluation losses A revaluation loss should be charged to profit or loss.

- Or another country that follows IFRS instead of GAAP, we could elect to perform a revaluation of that asset up to its fair market value as soon as we found out about that steep increase in value.

- The majority of fixed assets are purchased outright, but entities sometimes borrow funds to purchase fixed assets or pay to use a piece of property or equipment over a period of time.

- Prior to recording a journal entry, be sure that you have created a contra asset account for your accumulated depreciation, which will be used to track your accumulated depreciation expense entries to date.

Fixed Asset Accounting Explained with Examples, Journal Entries, and More

Changes to https://www.facebook.com/BooksTimeInc/ the status of an individual asset do not signal impairment, and, frequently, only the estimated service life needs adjusting. These scenarios and similar circumstances may prompt impairment testing. For example, a 30-year-old, coal-fired power plant is nearing retirement age and a new regulation appears, requiring millions of dollars in updates.

Depreciation of Fixed Asset

It includes the actual cost of the asset, transportation, installation, and any other expenses necessary to put the asset into service. Fixed assets, also known as long-term assets or non-current assets, are tangible or intangible resources held by a company for long-term use in its operations to generate income. These assets are not intended for resale but rather for continued use within the business to support its operations. There are four accounts (discussed below) affected when writing off a fixed asset at disposal. When you write something off the books, accounts with normal debit balances are credited and accounts with normal credit balances are debited.

Defining the Entries When Selling a Fixed Asset

- Our accounting experts provide standard journal entries, examples, guidance and helpful visuals.

- This entry debits $400 to Depreciation Expense and credits $400 to Accumulated Depreciation.

- This could be helpful to look at internally to gauge if fixed assets need to be replaced or if they are currently being replaced on an expected timely basis.

- Specifically the typical costs to be included for different types of asset are summarized below.

- We have more how-to’s when it comes to booking journal entries, which can be found right here.

If the revaluation takes place at the start of the year, then the revaluation should be accounted for immediately and depreciation should be charged in accordance with the rule above. Depreciation stops when fixed assets accounting entries the accumulated depreciation reaches the amount of the depreciable base. In example 1, a $100,000 asset with a four-year life and $10,000 salvage value, the following year-by-year breakdown shows the depreciation. For example, a manufacturing company purchases a machine on Dec. 1, 2019 for $56,000.

- This process ensures that the value of fixed assets is accurately reflected on the balance sheet and income statement over their useful lives.

- Upward revaluation is not considered a normal gain and is not recorded in income statement rather it is directly credited to a shareholders’ equity account called revaluation surplus.

- If a company buys an asset for $5000 and expects to sell it for $1000 in three years, it can then depreciate $4000.

- At the end of three years, the company expects to sell the asset for $1000.

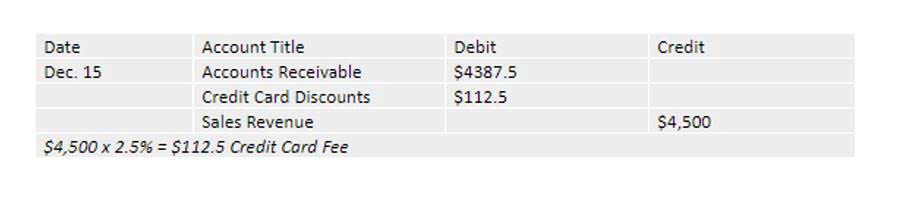

Furthermore the account is used to hold all gains, losses, and write offs of fixed assets as they are disposed of. Additionally the account is sometimes called the disposal account, gains/losses on disposal account, or sales of assets account. The simplest and most common method of calculating depreciation is the straight-line method, which is calculated as the asset’s cost divided by its useful life. Below are sample journal entries illustrating the acquisition of a fixed asset and recognition of depreciation expense. Prior to recording a journal entry, be sure that you have created a contra asset account for your accumulated depreciation, which will be used to track your accumulated depreciation expense entries to date.

How to calculate the depreciation expense journal entry

When recording a journal entry, you have two options, depending on your current accounting method. When a fixed asset is purchased, it is recorded as a debit to the fixed asset account and a credit to the cash or accounts payable account, depending on how it is paid for. To illustrate the journal entries, let’s assume that we have a fixed asset with an original cost of $50,000 and accumulated depreciation of $30,000 as of the beginning of the year. The fixed asset has no salvage value and it has a useful life of five years. As stated above, various methods may be used to calculate calculate depreciation for fixed assets.